Effective since January 1, 2024, the “Corporate Sustainability Reporting Directive” (CSRD) sets new standards and non-financial reporting obligations, but primarily affects a larger number of companies. While companies already subject to the NFRD will be relatively well-prepared, the approximately 40,000 other affected companies will need to anticipate and assess the impacts and risks of their activities on ESG criteria.

The CSRD: Principles and Changes

Definition of the CSRD

The CSRD, or Corporate Sustainability Reporting Directive, is part of the European Union’s efforts to strengthen CSR within companies. Integrated within the framework of the European Green Deal for Europe, this directive aims to enhance companies’ sustainability reporting requirements. The objectives are varied and primarily focused on improved environmental performance:

- Establishing a consistent ESG performance evaluation standard, notably through harmonizing corporate sustainability reporting

- Enhancing the availability and quality of ESG data, to simplify and make more accurate assessments of organizations’ impacts on the environment

- Promoting sustainable business development by emphasizing transparency and accountability, thereby encouraging companies to adopt more sustainable practices and take measures in favor of sustainability

- Identifying companies committed to sustainable practices, thus allowing for a more accurate assessment of their overall environmental impact through data collected by this directive.

This initiative follows the previous NFRD directive, or Non-Financial Reporting Directive, which previously set the rules for mandatory non-financial performance reporting but only applied to a small portion of European companies (approximately 11,000).

NFRD and CSRD, what are the differences?

Until now, the NFRD required certain large companies to share their response to the social and environmental challenges of our time. However, faced with the accelerating climate change, this information has not satisfied stakeholders, particularly investors. They struggled to assess companies’ non-financial performance, partly due to the lack of uniformity in ESG disclosures. This is where the CSRD comes in, approved to establish standards and obligations that companies must include annually in a non-financial report. This means that, in addition to the financial statements, an ESG report(environmental, social, and governance) must be published.

And it’s to address these gaps that the CSRD was adopted. But what really changes?

- More companies included

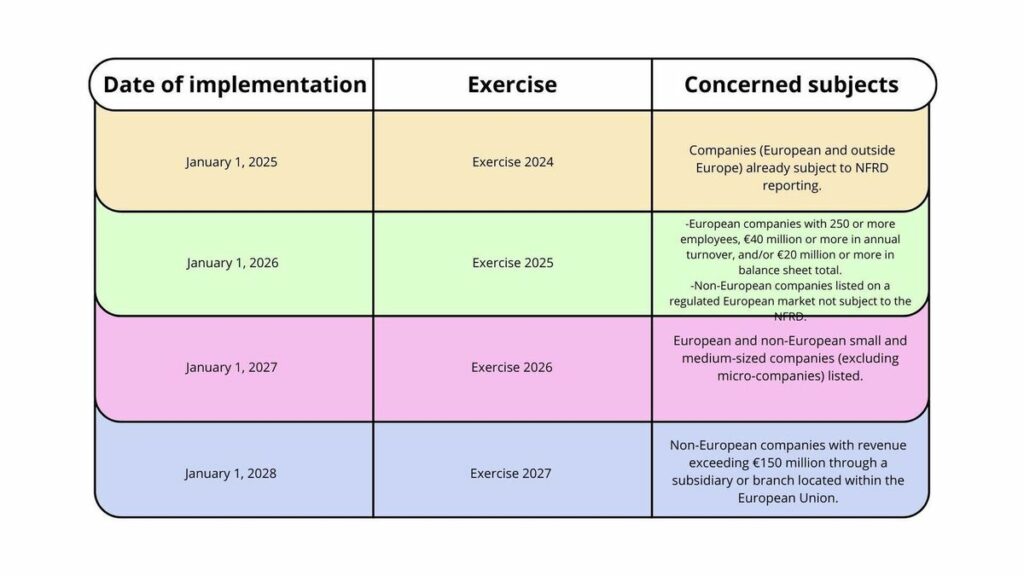

While the NFRD only applied to large companies with more than 500 employees, the CSRD applies to a broader scope of companies. Here are the subjects concerned, the date from which these companies must comply, and the reporting period they must adhere to :

- More detailed and comprehensive

Similar to the NFRD, this reporting focuses on non-financial data, emphasizing non-monetary elements such as environmental, social, individual, and overall ecosystem impacts of the company. The CSRD, however, aims to increase the accuracy and reliability of the information previously gathered by the NFRD, while standardizing this information in a report that adheres to a European standard.

- Dedicated section and verified information

To ensure transparency and reliability of shared information, the sustainability report will now be included in a separate section of the management report. The latter will be disseminated in a standardized European electronic format, XHTML, and will include specific tags defined in a new digital taxonomy established by a delegated act. The accuracy of the data will be mandatory verified by an auditor or an independent third-party organization, depending on the preferences of the member states. Initially, this verification will have a “moderate” level of assurance, with a possible transition to a “reasonable” level from 2028 onwards. Furthermore, auditors must adhere to strict assurance standards, with reinforced rules for their missions, as outlined in the directive and the Audit Regulation.

- Introduction of double materiality

Double materiality is THE key concept of the CSRD. This method of company assessment considers both financial elements, such as profits, and sustainability impacts, which include economic, social, and environmental aspects. Two aspects are distinguished: simple materiality and impact materiality. If these terms are unfamiliar to you, don’t worry, we explain them in our article!

The transition from the NFRD to the CSRD is a significant step towards greater transparency and more accurate assessment of companies’ non-financial performance. With stricter standards, mandatory verification, and the introduction of double materiality, the CSRD represents a solid foundation for responsible decision-making. For companies fully committed, this represents not only compliance with new standards but also an opportunity for leadership in the transition to a sustainable and inclusive economy.

Significant changes for real benefits

The CSRD directive offers numerous advantages to companies, helping to improve their sustainability and social and environmental responsibility. These benefits include:

Transparency and trust strengthening

By requiring more detailed and standardized sustainability reporting, the initiative promotes transparency about companies’ environmental, social, and governance activities and impacts. This enhanced transparency allows stakeholders to better assess companies’ performances, aiding them in making more informed decisions. With more comprehensive and reliable information on their ESG performance, companies can strengthen trust among investors, customers, and other stakeholders. This transparency helps establish strong trust relationships between companies and their stakeholders, which can translate into long-term business benefits.

Better risk management

The CSRD encourages companies to assess and disclose sustainability-related risks, enabling them to better understand and manage these risks while anticipating potential future regulations. By identifying and effectively managing ESG risks, companies can protect their reputation, reduce their exposure to risks, and seize new opportunities.

Access to sustainable financing

Companies demonstrating strong ESG performance can more easily attract sustainable investments and benefit from increased access to financing with low environmental and social impacts. By meeting transparency and ESG performance requirements, companies can access a wider range of funding sources and strengthen their market position.

Business opportunities

By integrating sustainability practices into their operations and effectively communicating about them, companies can identify new business opportunities, meet the growing demand from consumers for sustainable products and services, and remain competitive in the market. Sustainability can be a driver of innovation and differentiation for companies, allowing them to stand out from competitors and capture new market share.

Alignment with sustainability goals

The CSRD helps companies align with international and national sustainability goals, such as the United Nations Sustainable Development Goals and European Union initiatives like the European Green Deal. By integrating sustainability principles into their business strategy, companies can significantly contribute to achieving these goals and strengthen their legitimacy with stakeholders.

In summary, implementing the CSRD offers companies a range of tangible benefits, from increased transparency to new business opportunities, while helping them align with long-term sustainability goals. But as companies already subject to the NFRD have been dealing with the new directive since 2024.